how to file taxes if you're a nanny

First if your nanny decides to file income taxes and reports the income that would alert the IRS. If you and the nanny part ways and they file for unemployment that would alert the unemployment office that you never paid unemployment taxes.

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

If you were paid more than 1800 by one employer you should receive a W-2 as a Household EmployeeYou can read more here.

. Get the payroll information how much you paid how much social security tax you paid etc from the documentstoolsExcel sheet you used to manage the nannys payroll. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by January 31. The federal unemployment tax rate is 6 percent but many employers get a 54 percent credit against the tax.

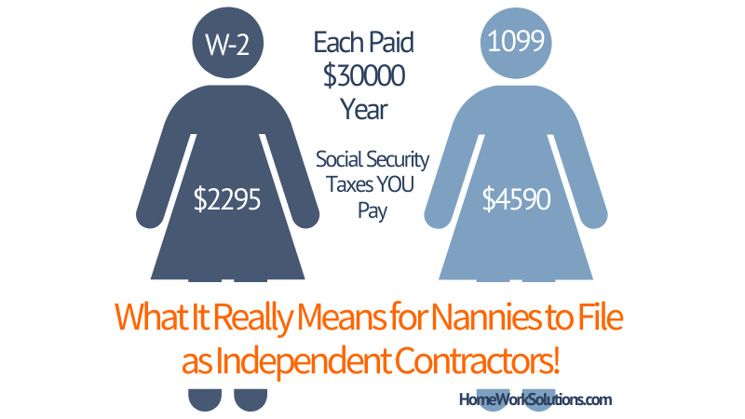

For example 765 of 600 is 4590. Their take-home pay is 46175. If you receive your W-2 after you filed your return using Form 4852 file an amended return using Form 1040X Amended US.

You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare. Attach Schedule C or C-E. Send the W-2 copy A with the W-3 to the Social Security Administration by the last day of January.

You will use this form to file your income tax return. File a return even if youre not required. Youll also contribute 3825 for FICA.

The maximum percentage of your expenses allowed as a credit for 2021 is 50 so 4000 for one child and 8000 for two or more children. For tax year 2020 FICA taxes will be applicable if a family paid you at least 2200 in the year and unemployment insurance taxes will have to be paid for wages of more than 1000 in a calendar quarter. This form will show your wages and any taxes withheld.

Prepare Schedule H and file it with your federal income tax return. When filing your 2021 taxes you can claim up to 8000 of qualifying child care expenses such as your nannys pay for one child or 16000 for two or more children. This form is in place of a W-2.

Your nanny works 40 hoursweek at 1250hour making their gross pay 500week. Child and Dependent Care Tax Credit. The bottom line of Schedule C on line 31 Net profit or loss will then flow to line 12 of Form 1040 Business income or loss.

Parents may also need to pay state unemployment taxes. Learn about how to file nanny taxes whether youre the nanny or the employer with this step-by-step guide. Your tax savings will depend on the tax bracket youre in and vary between 3600 and 4800 in 2021.

If your nanny completed a W-4 you can get the SSN from that document. If you earn less than 600 your employer does not need to provide any documentation. That surpasses the FUTA exclusion limit.

Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages. You would file Form 1040 using the W-2 provided by your employer. Household Employees and Taxes However if you earned less than 1800 per employer or you dont have a W-2 you may report this income under Wages Income Less Common IncomeChoose the Miscellaneous Income section if you.

The 20 percent credit on these expenses can save you 600 for families with one child or 1200 if you have two or more children. This process is time-consuming and can be confusing. To file these forms youll need a Tax ID.

When income tax season rolls around your employer is required to send you a Form 1099-MISC that reports all of the income they paid you during the last calendar year. How do you file taxes if youre a nanny. This lets you set aside up to 10500 of your annual income before taxes and then use that money to pay for child care expenses such as your nannys wages.

Youll retain 3825 for FICA from their pay. So if their gross pay is 1000 then you would be responsible to pay 7650. If the parents pay the nanny wages of 1000 or more in any calendar quarter they also need to pay federal unemployment tax on the first 7000 of wages.

You can claim up to 3000 of qualifying child care expenses such as your nannys pay paid in a year for one qualifying individual or 6000 for two or more qualifying individuals. Provide your nanny a W-2 for their income tax returns and file a W-2 Copy A and W-3 with the Social Security Administration. Complete a Form W-2 and give copies B C and 2 to the employee.

If something happens and your nanny needs to file for disability that would also be a red flag. If your gross income is below a threshold based on your filing status age and whether you are a dependent you dont need to file a return. So there details here but self employment on 17k profit is about 2400 its about 15 flat.

The annual total for FICA increases to 2300 in 2021. You use this to prepare and file your tax return on Form 1040. Then state income taxes.

When youre issuing your household employees paycheck you will. I am a nanny how do I pay my taxes. You may also need to fill out an Annual Reconciliation Form if your state requires it.

If youre a nanny who cares for children in your employers home youre likely an employee. Subtract your employees share from her gross wages and record the amount you owe. For more details and exceptions for when W-2 reporting is not required see Household Employment Taxes and Nanny Tax Guide.

Your employer is required to give you a form W2 by January 31st. Know what forms are required. As your nannys employer youre expected to pay your portion of Social Security and Medicare taxes which is 765 of his or her gross wages 62 goes to Social Security 145 for Medicare.

Reducing your overall taxable income by 10500 will reduce your tax burden. Finally youll need to submit a Schedule H which allows you to report household employment taxes with your federal income tax return. If you file Schedule H Form 1040 PDF you can avoid owing taxes with your return if you pay enough tax before you file your return to cover both the employment taxes for your household employee and your income tax.

1 level 1 6y. Youll likely need to pay state taxes as well. In addition to income taxes you will also be charged Self Employment Tax Social Security and Medicare at roughly a 15 rate.

At that same rate of pay your nanny will make 4500 in the quarter. That means you file taxes the same way as any other employed person. Best Online Brokerage for.

Calculate social security and Medicare taxes. If your nanny asked you to withhold federal income taxes you can use the. If youre determined to file your taxes by yourself make sure youre using the best programs available.

If youre not a dependent taxes are about 665 after deductions making a lot of assumptions and 1140 if you are a dependent.

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax Nanny

How Does A Nanny File Taxes As An Independent Contractor

Nanny Tax Do I Have To Pay It Credit Karma

The Differences Between A Nanny And A Babysitter

Nanny Tax Pitfalls And Need To Knows For Your Taxes

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay

21 Daycare Receipt Templates Pdf Doc Receipt Template Daycare Forms Daycare Contract

How To Easily Complete Taxes For Your Nanny By Nate Nielsen Medium

New Tax Reporting Rule May Change How You Pay A Nanny Or Babysitter

Guide To Paying Nanny Taxes In 2022

How To Calculate Your Nanny Taxes

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Tax Day Prep 10 Common Tax Deductions For Your Photography Business Filing Taxes Nanny Tax Photography Business