child tax credit monthly payments continue in 2022

How Will the Child Tax Credit Impact Families in 2022. Lawmakers havent given up on the fight for more expanded Child Tax Credit payments in 2022.

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

ET Parents of children age 17 and under got a 1000 bump in their child tax credit for 2021 half of which was paid in monthly installments.

. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child. What might change for child tax credits in 2022. SEE MORE Will You Have to Pay Back Your Child Tax Credit Payments.

If signed into law the White House says the bill would mean the 250 and 300 monthly payments would go out monthly in 2022. That includes the late payment of advance payments from July. Families must have earned 10000 or more in the past year to receive the full benefit -- the 10000 earnings threshold would be.

The enhanced CTC payments were originally included in the American Rescue Plan to help families through the pandemic as previously reported by GOBankingRates. That effort took a significant turn on Sunday. The law authorizing last years monthly payments clearly states that no payments 1.

Advanced monthly payments totaled. Heres what you should know about the push for more benefits. How do you apply.

To receive 2022 child tax credit payments families must wait until next years tax season. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. 2 days agoThe new child tax credit proposal includes a work requirement.

The law authorizing last years monthly payments. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your taxes in 2022. President Biden wants to continue the child tax credit payments in 2022.

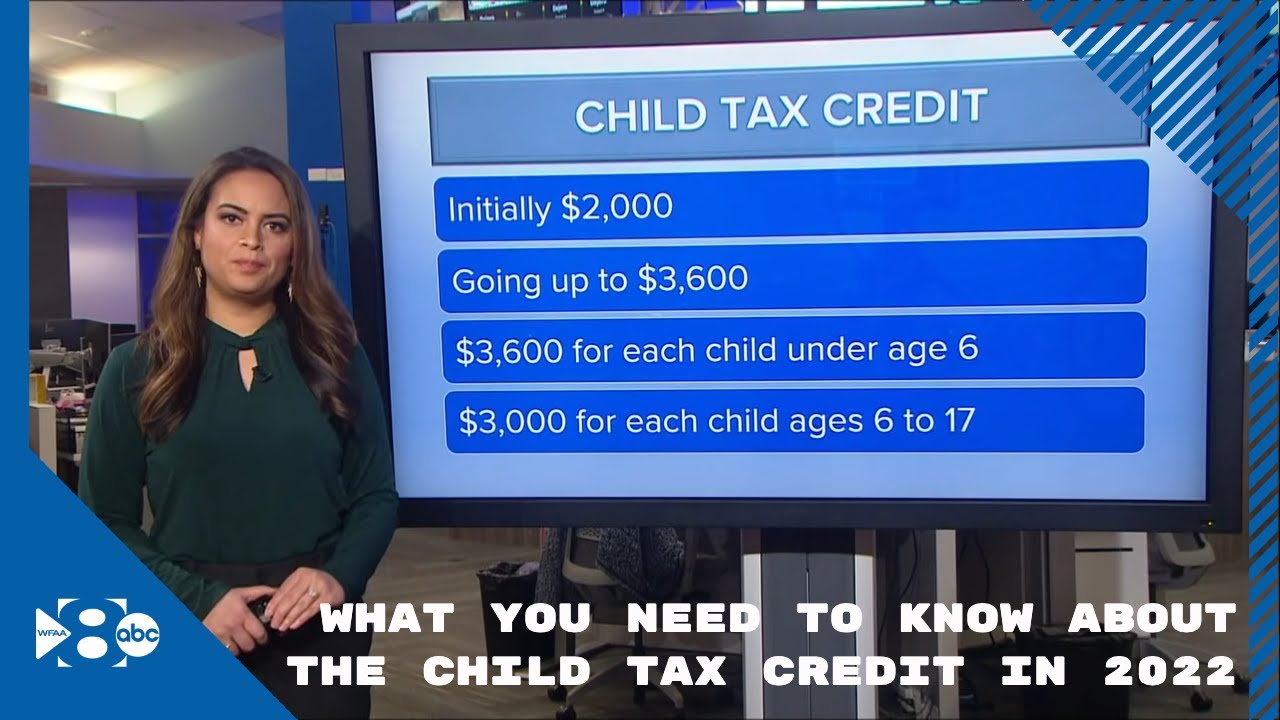

The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. Child Tax Credit Payments Still Arent Getting to Those Who Need Them Most. It may require single filers to have an AGI of 75000 112500 for head of household filers and 150000 for joint filers.

I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022. Families who qualify for the enhanced Child Tax Credit benefits may see their final advanced payments as the program is scheduled to end Dec15 unless Congress extends it. The monthly payments could continue but instead of being spread over a 6 month span they could be stretched over a 12 month span.

If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of your credit by claiming the Child Tax Credit for that child when you file a 2021 tax return during the 2022 tax filing season. In total itd cover 35 million householdsor 90 of those with. The monthly payments started in July and ended in December with families receiving in cash up to half the credits total value of 3600 per child under 6 and 3000 per child ages 6 through 17.

In fact he wants to try to make those payments last for years to come all the way through 2025. This credit begins to phase down to 2000 per child once household income reaches 75000 for individuals 112500 for heads of household and 150000 for married couples. The new expansion to the Child Tax Credit is temporary.

As it stands right now child tax credit payments wont be renewed this year. The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress. By Danielle Letenyei Jan.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. However Congress had to. And while the final monthly payment of 2021 went out Dec.

Check out The Ascents best tax software for. Washington lawmakers may still revisit expanding the child tax credit. The 2022 child tax credit is set to revert back to 2000 for each dependent age 17 or younger.

But is ending payments a wise decision as the economy continues to struggle. During the second half of 2022 parents enjoyed monthly Child Tax Credit payments. The American Rescue Plan allows families to opt in to receive the monthly payments.

But this may not preclude these. The child tax credit will continue in some form. 19 2022 Published 1232 pm.

Key points While last years monthly Child. Distributing families eligible credit through monthly checks for. The enhanced monthly child tax credit payments ended seven months ago increasing the number of children in poverty from 121 to 17 putting 37 million children below the poverty lineMillions.

Whether that includes monthly payments and how many parents will be eligible will be up to Congress. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. 15 there is still more of that money coming to Americans in 2022.

But the changes they may make. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. Those payments are off the table for now but the credit isnt gone.

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

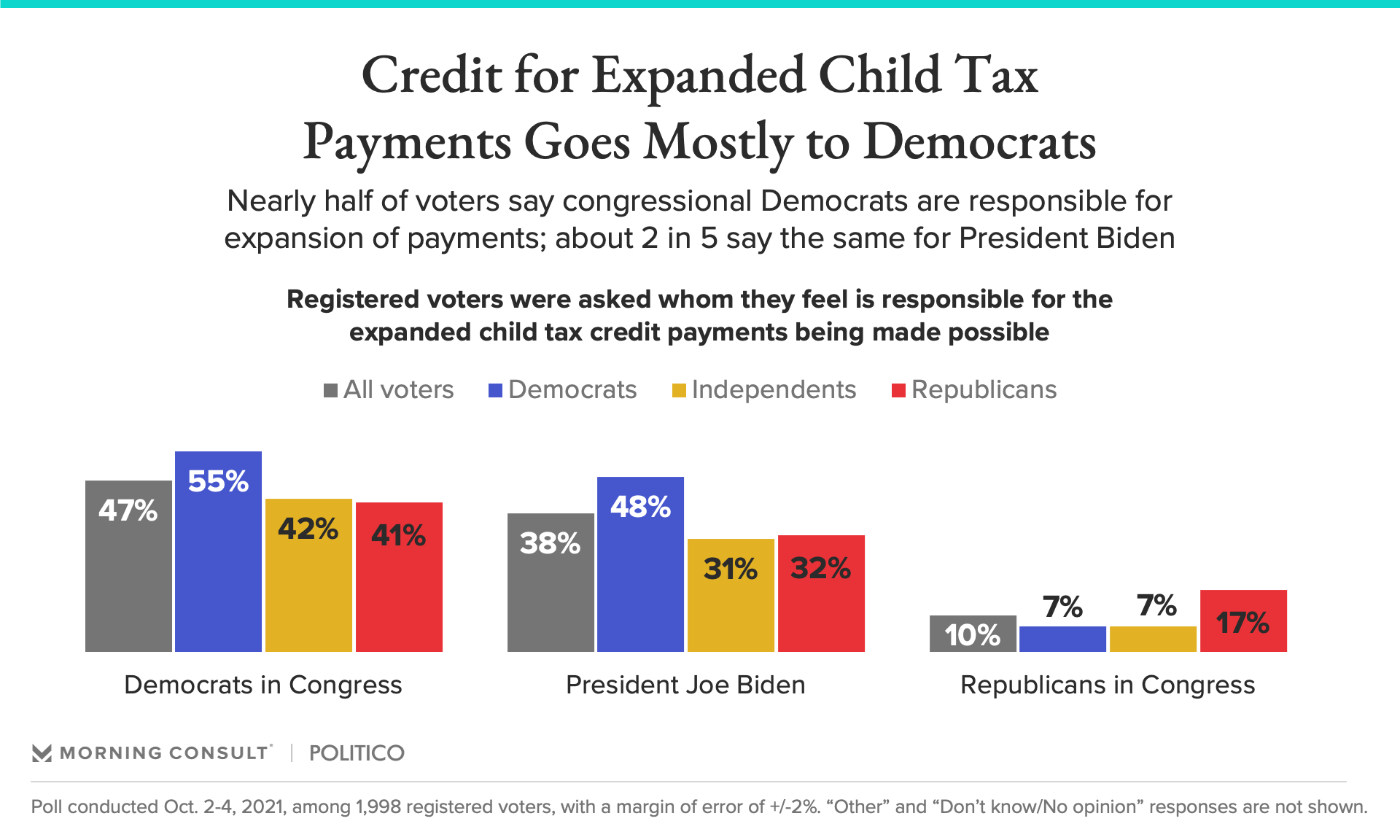

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

What You Need To Know About The Child Tax Credit In 2022 Youtube

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Explaining The New 2022 Child Tax Credit And How To Claim Familyeducation

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

No More Monthly Child Tax Credits Now What

Child Tax Credit Parents Struggle And Poverty Expected To Rise As Enhanced Benefits End Cnnpolitics

What You Need To Know About The Child Tax Credit In 2022 Youtube

Monthly Child Tax Credit Payments Set To Expire At The End Of The Year

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor Fingerlakes1 Com

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit 2022 Update Americans Can Get Direct Payments Up To 750 But Deadline To Apply Is Just Weeks Away